Moral: Wherein we welcome

Ben to blog sphere and ponder what that might mean.

Well, he has a book coming soon; and, the web/cloud has been a great avenue to get attention. But, it looks like he is offering his viewpoint, as well.

Plus, he is not (supposedly, as) constrained as before, to wit his lectures of 2012:

Ben I,

Ben II,

Ben III,

Ben IV, and, my

Ah Ben. Gosh, it seems like yesterday that he took the time to tell us his view.

---

We, the savers, have survived being

slapped silly, though. And, we will continue to tell the story from a position that is very much unknown to Ben and his ilk (albeit, they are more wont to smear over us with abstractions than to deal with the reality of our existences). Nevertheless, the view from the common man needs to be lifted to awareness (and, such a view is as educated, and can be as deliberate, as is that (those) of the ones who look down from their heights on the rest of humanity).

---

So, Ben blogs, early, on interest:

Why so low? Nice to see the comments that he got. We will have to see if he responds to any, specifically. The Brookings site says that the comment activity is high.

We will do our interchange via our own method, in this mode.

Right now, let's just introduce the new means to hear from Ben who has been away from our sight for a little bit. Definitely, his new way lightens up the landscape.

---

Note: the 1% and less (as in, that very small group) are more of concern to the Fed than the 99%. We will get to that. What happened to moral hazard (and how it might influence low interest)?

---

King Alan? You too old to blog (I'm over 73 myself)? We, the people, want to hear from you.

Remarks: Modified: 06/04/2015

03/31/2015 -- Ben has a chart showing a decline in interest. Well, guy, that correlates, very well - inversely, with advances in computational mathematics and finance. You see. The computer allows easier gaming of the system, for some. Others bear the consequences. Like yesterday. It was a seeding day. Today, things turned around as those who can take their profits from the late-coming idiots. I can explain this in detail (and will, over time). Yes, the FED has to take normative stances. But, it, too, needs to wake up to the insidious cancer that comes from technology when it is let to run amok.

03/31/2015 -- Today, Ben gets to ruffle

Larry's feathers. Four hours after his post, there were no comments. Technical glitch on the blog? Readers stopping to think (say what?)? The issue is secular stagnation.

Janet is worried, says CNBC. Comments at the CNBC post bring in good points (that ought to be itemized). ... However, I'm stepping back so as to change the context. Notice that Ben has three objectives of economic (read, monetary) policy: full employment, low inflation, financial stability. Given his monetary leanings, how can he consider that the wizardry required (as now being attempted by Janet and her crew) is not unlike a planned economy (gosh, at the core, not unlike that attempted by the communistic/socialistic crowd)? ... For those who might wonder, think

input-output model which is laughed at by the capitalistic (invisible hand - whose?) bunch. ... So, is there another view? Yes, that which embraces near zero as a crucial entity for sustainability.

04/01/2015 -- Larry's feathers are referenced in the 2nd post (see prior comment). Then, today,

Larry responds. Plus, Ben goes on about the

savings glut. ... Three major posts in three days. Well, that confirms that Ben is not the usual blogger, as in, sitting at the keyboard hacking out words. However, if Ben can show a better way to use the blog medium, I'm for that. How much help does he have?

04/02/2015 -- Ah, mercy. I was wondering if Ben would snow us with an avalanche that has been building for some time. Any bets on the next post and topic?

04/04/2015 -- Yesterday, Ben talked

Germany's problem. My take before reading his post: how is it that such an industrious people have the rest of the community on their backs (some proverbial bit there?)? My take after a browse: infrastructural investment? How about suggesting that for this great nation's failing backbone? Ben needs to drive around, himself behind the wheel, and to take a close look at the erosion. ... There is a glimmer of hope; Ben talking socially-oriented steps (raise wages, fund infrastructure)? After all, my reaction comes from him having been installed by a Republican administration which does have implications about his view on the world or how his views were perceived (will we ever hear from Bush on Ben?).

04/08/2015 -- Now, the IMF weighs in (on

Larry's side). Pissing contest? So, my take is to start from scratch and build something,

constructively. I'll watch this from far enough away to not get splattered. Ah, males.

04/09/2015 --

Stability was Ben's topic on the 7th. I want to ask the guy how he sees such in the financial realm (irregardless of the FED's put) when the underpinnings are an amoral exploitation of mathematics and computation just because it can be done under various types of cloaks (proprietary, sleight of hand, etc.)?

04/15/2015 -- The last two posts were:

Low interest #4 and

Hiking wages in Germany.

04/16/2015 --

Monetary policy, what? This is last update here. We'll comment elsewhere, such as this bit in

truth engineering.

04/20/2015 -- How long will

Ben blog?

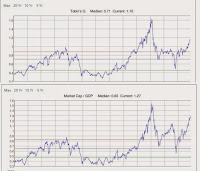

04/24/2015 -- The questions stands. As of now, the last post was April 14th. ... So, today, the NASDAQ was up in record range. Nice, Ben and Janet. Looking at the chart, we can see the drop after the tech bust and notice a little dip with the great recession (just past, caused by the finaglings of the finance crowd). ... The, straight up since the bolstering from the largess (all sorts). ... All on the backs of the savers.

05/01/2015 -- Well, Ben came back. Not for long, though:

Taylor,

WSJ's view.

06/02/2015 -- It wasn't my imagination. Ben slowed down. He was going bonkers there for awhile. The latest post has to do with

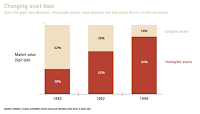

inequality. Ben goes on about "value" and how it has been used. But, does he ever think of the

magical multiplier? That is, the financial scheming that is done daily is the direct result of "Fed" dalliances with Wall Street (and similar ilk). ... So, Ben, please consider that the ca-pital-sino, no matter what infatuation that you might have for it, is not how we ought to base the poor's future. Unless, there are gigantic taxes on "capital" gains, especially those of the "fictitious" nature (which is most given the current configuration). ... Gosh, they sure cut off comments soon. Is it due to an accumulation of critical reactions?